Blog

Bracing for the Silver Tsunami: How to Engage with Members Aging Into Medicare Advantage

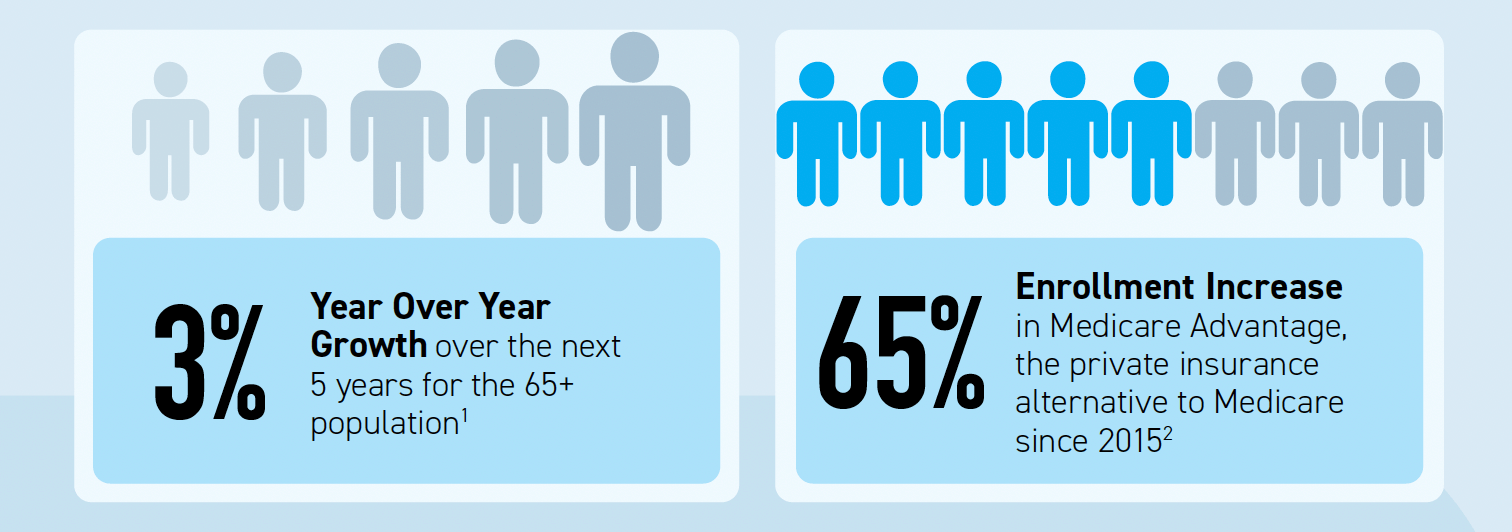

As the U.S population ages, health payers and Medicare Advantage (MA) leaders are preparing for the “Silver Tsunami” – an influx of aging Americans now eligible for Medicare Advantage coverage. To put this in perspective, the 65 and older population is projected to grow by 3% YoY over the next five years and Medicare Advantage enrollment has increased by 65% since 2015. To ensure success in this new market, it is critical for Medicare Advantage plans to understand how to attract, onboard and retain members to build loyalty and maximize their value.

Attracting Medicare Advantage Members

As the aging-in population continues to grow, it’s important for health payers and Medicare Advantage leaders to create innovative strategies to target and attract potential members. According to Forrester, the biggest challenge for 28% of adults aging into Medicare is figuring out what health insurance plan best suits their needs. With a sea of options available to potential members, it is more important than ever for health payers to find ways to differentiate themselves and break through the noise.

There are many factors that members take into account when choosing a Medicare or MA plan including: costs, plan benefits, convenience, and Star Ratings, among other things. So, what are ways that health payers can stand out as the best choice to attract the aging-in population and gain a more significant share of this booming market?

During a Relay-hosted webinar with thINc, a staggering statistic was shared around retention of aging-in health payer members: “health payers can lose up to 80% of their members upon aging into Medicare”. Given the optionality of MA plans in the market, the aging-in population now have a choice in their health coverage, as opposed to their experience with employer-based plans.

The conclusion: health payers with MA plans need to communicate their options to existing members who they know are aging-in.

While marketing to the outside aging-in population is still important, reaching out to existing members who are making first-time plan selections can help with differentiation in a competitive market. By leveraging the already established relationships with those members, health payers can utilize existing channels to communicate and engage with their aging-in population to educate them on plan options, connect them with an MA advisor for guidance, and even provide an opportunity to enroll in the plan seamlessly when the time is right.

The next step is ensuring that these members, and any other new members the health payer has enrolled, are properly onboarded.

Onboarding Medicare Advantage Members

Once new MA members have enrolled in the plan, proper onboarding is the next important step. There is only one chance to make a good first impression, and that impression carries even more weight since MA members can easily switch plans if they aren’t satisfied.

According to a McKinsey study, there is a significant gap in onboarding with the MA population, with majority of respondents (66%) reporting they received information in the mail but were not further engaged after that. While some others reported receiving information via email or phone calls, 15% of respondents reported receiving no information after choosing their plan.

Health payers have an opportunity to create a more streamlined and personalized onboarding experience with their MA members. That same McKinsey study referenced four onboarding experiences that MA members were not fully satisfied with: access to resources for specific medical condition, digital offerings to improve health, selecting a primary care physician, and enrolling in additional benefits. These experiences are table stakes and could be the difference-maker between a member staying with a plan or shopping for a new one during the AEP.

Additionally, digital offerings are viewed as increasingly important in the plan selection process, yet only 48 percent of members reported being fully satisfied with online features during onboarding. By upping the digital experience game, and providing tools that are familiar and preferred, MA plans can create a better onboarding experience for their members.

Conclusion: Onboarding new MA members can be improved, and despite what some may think, the use of digital tools is the now the best and preferred way to communicate with this population.

Onboarding that leads to a good experience can also impact plan performance and Star Ratings, which are an important indicator of a good MA plan when members are making their decision. In fact, customer experience will account for approximately 57% of overall Star Ratings in 2023, making it an even more important focus for MA plans today. And for plans, high Star Ratings can have a significant financial impact as well, creating an even greater impetus for improvement.

All of these things can also impact the overall retention of members which rounds out the priorities for MA plans in this space.

Retaining Medicare Advantage Members

Post-onboarding, consistent and timely engagement and support is key to retaining MA members. This can be done through regular communication that: educates members about plan options or services available, provides health assessment surveys and access to care, delivers personalized recommendations based on individual health journeys, and helps with chronic disease management and preventive care.

But what is the best way to communicate to with the MA population? According to Forbes, the ability to provide engaging digital experiences to improve access and care is emerging as the most critical strategic differentiator for health plans, especially for the MA population. Digital is here to stay, even with the aging-in population. Consider these stats: 68% of Baby Boomers own a smartphone, 59% use social media, and 1 in 3 people ages 60-69 use their phone to manage medical care.

Conclusion: Digital solutions like feed technology, where relevant and important experiences are delivered on a familiar and consistent channel, will help to keep members engaged and drive them to complete actions necessary to stay healthy. Plus, through this type of personalized engagement, MA plans can build loyalty and trust with members that drives retention with their plans.

Conclusion

The Medicare Advantage market is booming, so there is no better time than now for health payers to prioritize this population and their needs. Plus, the lifetime value of an MA member is over 3 times that of a large group member and almost 10x that of an individual member, so the potential return on investment for engaging and retaining this group is massive. By utilizing digital tools combined with streamlined onboarding processes along with member engagement initiatives, health payers and MA plan leaders can effectively capture the attention of this growing demographic while providing a valuable service that improves quality of life for those enrolled in their plans.

To learn more about how Relay Member Feeds can help enhance overall member and patient experience, receive your own feed by clicking the link below: